OUR THINKING

RESEARCH & THOUGHT PIECES FROM OUR TEAM

In December, we published a press release detailing the Lipper Broadridge - Best Managers rankings for our U.S. Multi-Cap Value strategy. Since publication, we have received several questions asking how we achieved this recognition and what our ‘secret’ is. With this in mind, we decided to publish t...

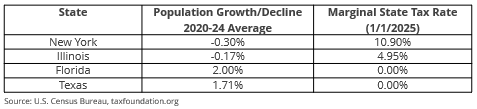

Many years ago, MAP’s President & Chief Investment Officer Michael Dzialo’s mentor would always say to him: “money goes where it’s respected.” We are seeing this play out in today’s markets in several ways. Citizens of high tax jurisdictions such as New York and Illinois are moving to states with ...

Since the turn of the 20th Century, there has been no shortage of global war and conflict for the markets to navigate. With summer approaching, rather than facing the heat of the sun, the markets face the heat of yet another conflict. So far cooler heads have prevailed as the headline risk of the Is...

The last 25 years in the markets have been nothing short of historic. Expansions and contractions, global conflicts, and rapid changes in technology and legislation have reshaped the financial landscape. From the dot-com bubble, the September 11 attacks, the Great Financial Crisis (GFC), and the COV...

For years, the Investment Team has cautioned against the allure of China’s vast market. Recent developments have only reinforced our stance. Despite possessing the world’s second largest economy and population, China remains a minefield for foreign investors, plagued by a lack of transparency, gover...

With stock prices plunging, it is logical to wonder: “why not move to cash until the tariff tantrum ends?”

We equate the current scenario to the early weeks of the COVID-19 crisis. Stocks tumbled as the virus spread and the economy ground to a halt. Many clients called wanting to move to cash, indi...

President Trump’s long-awaited ‘Liberation Day‘ proved to be more draconian than most investors expected. Stocks and the U.S. dollar both responded by falling sharply. While many of the details need to be worked out, tariffs of 54% on goods coming from China (34% from reciprocal tariffs and 20% for ...

Since 2022, investors have largely been rewarded for snapping up the fastest growing companies, regardless of valuations. But with a potential cloud hovering over the U.S. economy, and the changing winds of a new administration in full swing, before buying, we believe it is finally time ask: “but at...

Recently, one of our analysts inherited a grandfather clock. It is a beautiful piece that we are guessing is from the 1960’s. It was bought with the first commission earned by his mother-in-law who was a real estate agent in northern Wisconsin. When tuned properly, the clock’s pendulum is nearly hyp...

For many of us in the Detroit metro area, disappointment does not even begin to describe the heart-wrenching loss that our beloved Lions took on Saturday. While fans and players should both feel proud of everything the team accomplished this season, and they are primed to contend for a title again i...

Thanks to favorable market conditions led by advancing technologies, the stock market has been defined by strong returns over the past several years. Over the same period, volatility surges have also come to define the market, as stocks trading at historically high valuations are increasingly sensit...

What is the difference between a political pollster and a weather forecaster?

The weatherperson sometimes gets it right.

Yet again, the political pollsters got it wrong. Donald Trump won the U.S. Presidency, convincingly, defying the pollsters, who forecasted a neck-and-neck race. The Republicans...

CONNECT WITH US

Subscribe to our mailing list to stay connected with our investing insights, webinars and latest news.

Managed Asset Portfolios, LLC is registered as an investment advisor with the United States Securities and Exchange Commission (SEC). Registration as an investment advisor with the SEC is not an endorsement and does not imply any level of skill or training.

Managed Asset Portfolios, LLC claims compliance with the Global Investment Performance Standards (GIPS®). To obtain a compliant performance presentation and/or the firm’s list of composite descriptions please click on the Contact Us portion of this website, or call us directly at (248) 601-6677.

For additional detailed information about Managed Asset Portfolios, LLC including fees, services and other important information, please carefully read our current Client Relationship Summary (ADV Part 3) and Disclosure Brochure (ADV Part 2A) before you invest.

This website does not constitute an offer or recommendation by Managed Asset Portfolios, LLC of any securities, or an offer of services to any person residing in any jurisdiction in which such solicitation would be unlawful under the applicable laws and regulations. Managed Asset Portfolios, LLC complies with the notice filing requirements imposed upon SEC-registered investment advisors by those states in which the firm maintains clients, or qualifies for an exemption or exclusion from the notice filing requirements.

The website is limited to the dissemination of general information pertaining to investment advisory services provided by Managed Asset Portfolios, LLC. The information reflected on this website should not be construed as personalized investment advice and should not be considered as a recommendation for any specific investment product, strategy, or other purpose. For more information, please see Terms of Use which governs your use of this website.

Please don't hesitate to Contact Us if you have any questions.

This website uses cookies. For more information please see the website Privacy Policy.